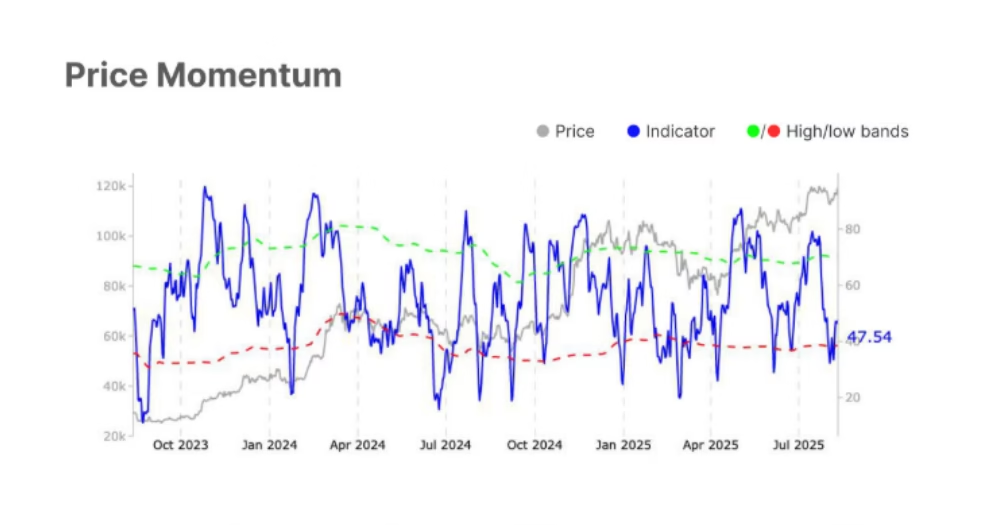

The blockchain analytics agency Glassnode shared its weekly report, which options numerous key metrics and on-chain knowledge associated to the main cryptocurrency. Spot Metrics The spot worth rebounded strongly over the previous week, after re-testing the sub-$114,000 degree and climbing again in direction of $121,000. This introduced momentum again into the spot market, with a number of sectors exhibiting indicators of renewed consumer exercise, though a detailed eye is to be stored on the situations. The Relative Energy Index (RSI), which measures the pace and alter of worth actions by calculating the common good points & losses over (often) 14 days, has elevated to 47.5, marking a 14.5% achieve. This indicators a strengthening investor curiosity and a possible bullish shift; nonetheless, because the RSI is under the midpoint, it warrants warning because the momentum wants to carry to substantiate the pattern. Supply: Glassnode In the meantime, Spot Quantity decreased from $7.3 billion to $5.7 billion, representing a 22% discount, which signifies lowered market engagement and fewer contributors in comparison with earlier weeks. Futures Metrics Open Curiosity, the benchmark that measures the entire variety of energetic positions, has decreased to $44.1 billion from $44.6 billion, indicating a slight discount in leveraged buying and selling, possible as a consequence of profit-taking or liquidations. Supply: Glassnode The Funding Price (charges paid by longs to shorts, permitting them to keep up their positions) particularly for lengthy positions declined by 2% to $2.9 million. Whereas this hints at a cooling bullish sentiment, the demand for these positions stays excessive. Choices Metrics Open curiosity within the choices market has elevated in comparison with futures, reaching $42.4 billion. This represents a 6.74% enhance from final week and may be attributed to rising market engagement, pushed by speculative positions and numerous buying and selling methods. Supply: Coinglass The Volatility Unfold (measures whether or not choices overprice danger; increased readings point out higher concern) has dropped to 10.45% from 31.97% final week, signaling that merchants predict much less volatility. US Spot ETFs It’s trying good on the ETF markets, with the weekly web flows (the distinction between cash going out and in of the funds) rising over 54% from -$686 million to -$311 million, which is a major discount in outflows. This might result in the beginning of a brand new wave of accumulation. Supply: Glassnode In contrast, the Commerce Quantity (general buying and selling exercise over a particular interval) has skilled a 27.7% drop to $13.7 billion, which might point out a consolidation section inside the market or vendor exhaustion. Basic Metrics The each day energetic handle rely has risen to 793,000, indicating elevated consumer engagement on the community, possible pushed by current worth actions. If this retains up, a extra energetic section could also be on the horizon. Supply: Glassnode On-chain switch quantity, a metric that tracks the entire quantity of transactions carried out instantly on the blockchain, has dropped barely from $8.6B to $8.5B, however stays regular. This follows a current sharp decline, suggesting renewed curiosity. Supply: Glassnode The submit Bitcoin Bounces Back This Week, But Glassnode Sees Trouble Ahead appeared first on CryptoPotato. Powered by WPeMatico